Current accounts

|

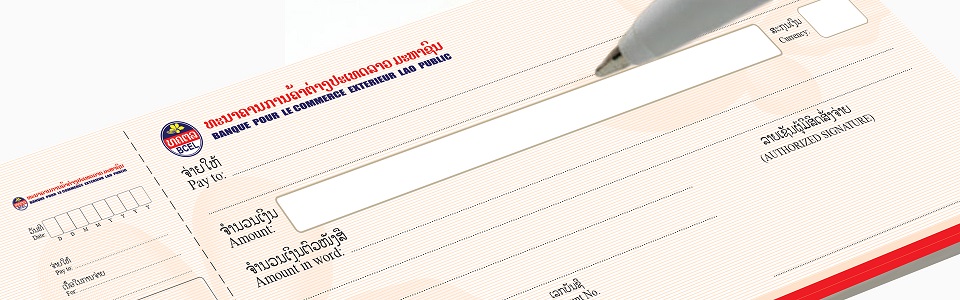

Product Name |

Current accounts |

|

Description |

The current accounts help the depositors to manage and organize their financial liquidity and they can be safely used for making payments for goods and services by using cheques instead of cash. This type of account is suitable for individuals and corporates that operate the business with regular cash flow. |

|

Benefits |

|

|

Fee |

|

|

Regulations |

|

BCEL I-Bank

BCEL I-Bank

BCEL One

BCEL One